Understanding Leasehold and Freehold

Understanding Leasehold and Freehold

Property Ownership in Indonesia for Expats

In Indonesia, the concepts of leasehold and freehold are fundamental when it comes to owning property, especially for expats who are considering investing in the country’s real estate market. Here’s a breakdown of the key differences between the two and what expats need to know about these rules:

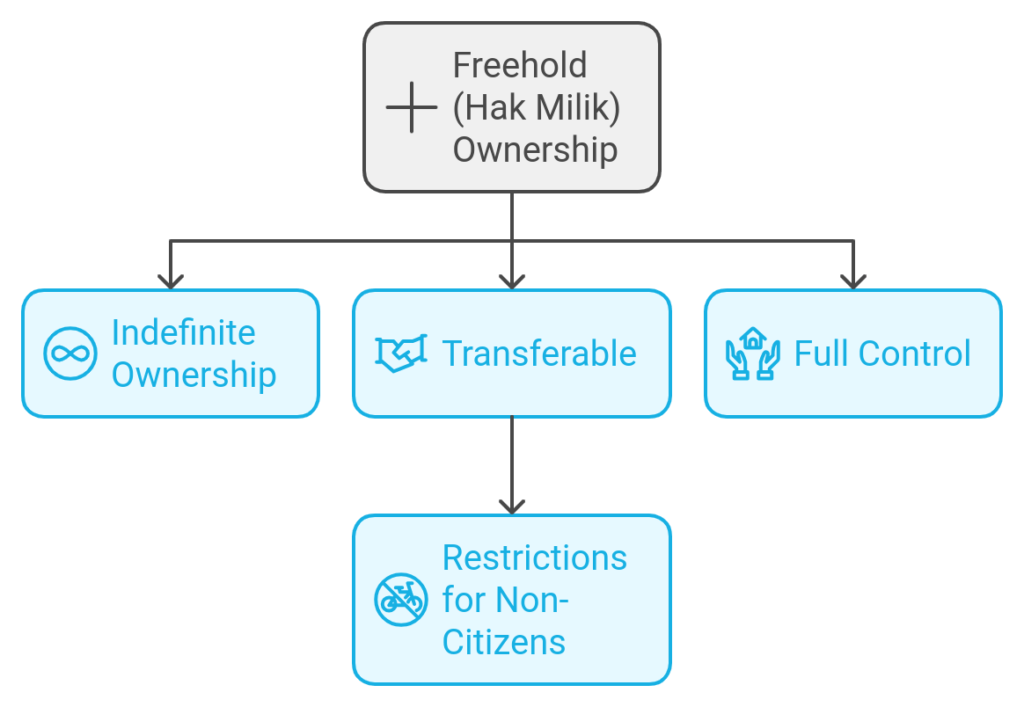

1. Freehold (Hak Milik)

Definition:

- Hak Milik, or freehold, represents the most comprehensive form of property ownership. You hold the land title indefinitely and have the freedom to transfer or sell the property.

Key Features:

- Indefinite Ownership: You own the property outright without any time restrictions.

- Transferable: You can sell, inherit, or transfer the property freely (if you’re an Indonesian citizen).

- Full Control: You control the property and the land it occupies.

Restrictions for Expats:

- Expats looking to invest in property must explore alternative methods, such as:

- Nominee structures: Where an Indonesian citizen holds the title on behalf of the foreigner (this carries legal risks).

- Setting up a foreign-owned company (PT PMA): This structure allows a company to own property, though not as freehold. The ownership will be under other titles like Hak Guna Bangunan (HGB).

Establishing a foreign-owned company (PT PMA): This allows the company to own property, but not directly as freehold (ownership will be in the form of other titles like Hak Guna Bangunan or HGB).

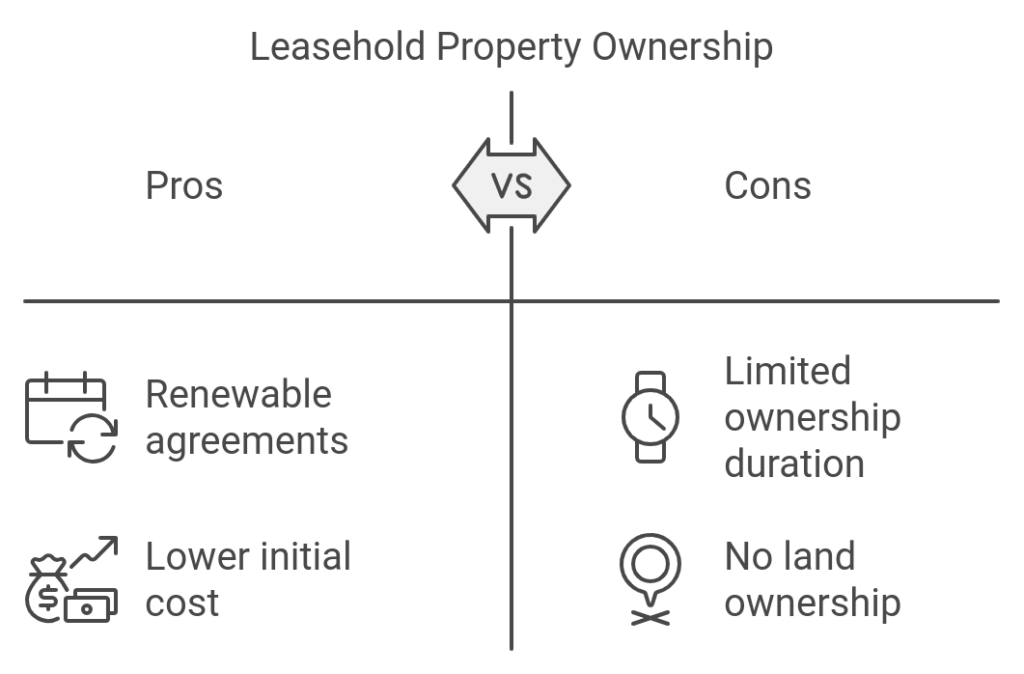

2. Leasehold (Hak Sewa)

Definition:

- Hak Sewa, or leasehold, gives you the rights to use the property for a specific period, after which ownership reverts to the original owner.

Key Features:

- Time-Limited Ownership: Leaseholds usually last 25 to 99 years, depending on the contract.

- Renewable: You can extend or renew the lease based on agreed terms.

- No Land Ownership: You have rights to the property for the lease period but don’t own the land.

- Lower Investment Costs: Leaseholds often cost less than freeholds since you’re not buying the land.

What Expats Need to Know:

- Leasehold is one of the few legal ways for expats to invest in property. Expats can hold leasehold rights for a property and fully use it during the lease period.

- Lease duration and renewal clauses should be clearly negotiated and included in the contract to avoid any potential future disputes.

- Flexibility: Leasehold gives expats the flexibility to live or invest in Indonesia without the complexity of legal ownership issues.

- Transferability: Some leasehold contracts allow the rights to be transferred or sub-leased, making it a potentially valuable asset during the lease period.

3. Other Ownership Structures for Expats

While leasehold and freehold are the primary types of ownership, there are a few other ownership structures that expats may encounter:

- Hak Pakai (Right of Use): Expats can own property under Hak Pakai, where they are granted the right to use the land or property for a specific period (usually up to 80 years with renewals).

- Hak Guna Bangunan (HGB): This is a right to build on land that is not owned by the expat. It’s commonly used by foreign-owned companies and can be granted for up to 30 years with the option for renewal.

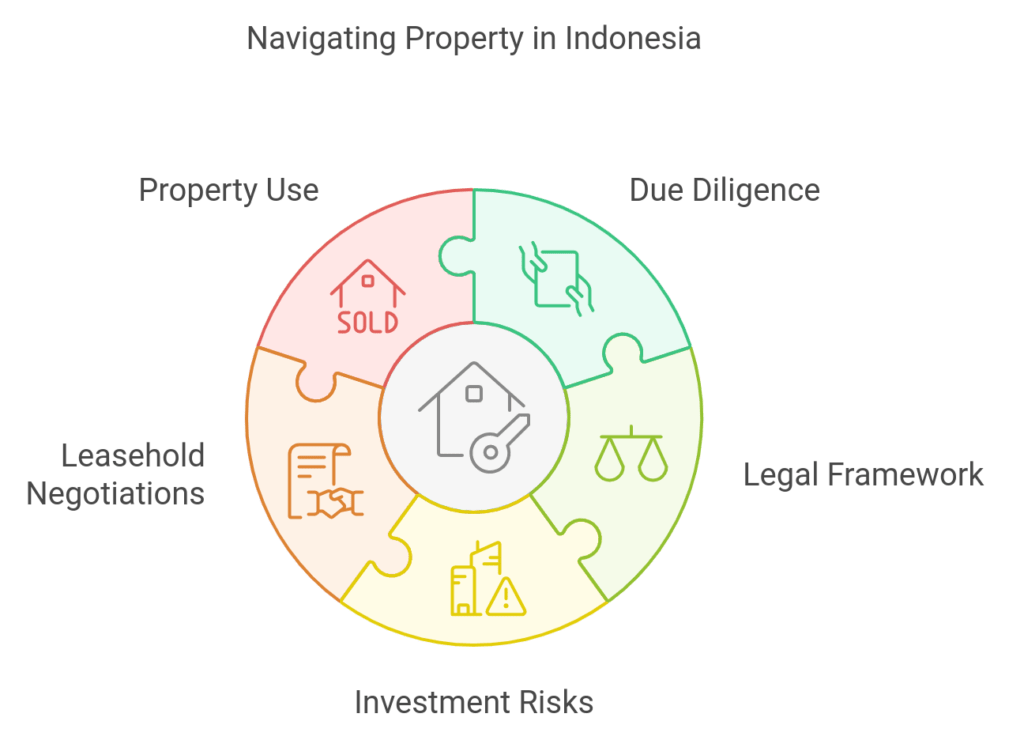

Key Considerations for Expats:

Due Diligence:

- Before signing any lease or purchase agreement, it is crucial for expats to seek legal advice and conduct thorough due diligence.

- Use a licensed notary to ensure that all documents are legal and binding.

Understand the Legal Framework:

- Property ownership laws in Indonesia can be complex and vary depending on your residency status.

- Expats should familiarize themselves with Indonesian property law and work with a real estate agent or lawyer who understands the local regulations.

Investment Risks:

- For expats considering nominee arrangements (having an Indonesian citizen hold the property title), it is important to know that such agreements are risky and not recognized under Indonesian law. Legal disputes or changes in government policies can jeopardize the arrangement.

Renewal of Leaseholds:

- Negotiate renewal terms upfront to ensure you can extend your lease at a fair price in the future.

Property for Personal Use vs. Investment:

- Whether the property is for personal use or investment purposes may influence your decision to go with freehold (if you can access it via a PT PMA) or leasehold. Leasehold might be ideal for short to medium-term investments.

Conclusion:

For expats, leasehold is the most straightforward and legally secure option for acquiring property in Indonesia, while freehold is not accessible unless through a complex legal structure such as a foreign-owned company. Understanding the legal landscape and working with trusted professionals is key to navigating the Indonesian property market safely.

Hepta Solutions can assist expats by providing consultation and services for navigating these challenges, including legal assistance, property searches, and structuring property ownership safely and effectively.

If you’re an expat interested in investing in Bali’s property market, consider booking a consultation with Hepta Solutions to explore your options and protect your investment. Book your consultation.

I am extremely inspired with your writing abilities as smartly as with the format to

your weblog. Is this a paid subject or did you customize it your self?

Either way keep up the excellent quality writing, it’s rare to see a nice blog like this one these days.

Beehiiv!

I’m really impressed together with your writing skills and also with the format in your blog.

Is that this a paid topic or did you modify it your self?

Anyway keep up the excellent quality writing, it is uncommon to look a great blog like this one

nowadays. HeyGen!